The #1 Thing Sellers Need To Know About Their Asking Price

For Sellers Laura Miller Edwards Realty Group April 30, 2025

For Sellers Laura Miller Edwards Realty Group April 30, 2025

When you put your house on the market, you want to sell it quickly and for the best price possible; that's generally the goal. But too many sellers are shooting too high right now. They don’t realize the market has shifted as inventory has grown. The side effect? Price cuts are on the rise, but they really don’t have to be. Here’s why.

According to data from Realtor.com, in February, price cuts were the highest they’ve been in any other February since 2019 (see graph below):

If you consider that 2019 was the last true normal year for the housing market – that's a big deal. We’re getting back to what’s typical for the market.

This isn’t the same frenzied seller’s market we saw a few years ago. You may not get the same price your neighbor did at the height of the pandemic. And that means you may need to reset your expectations.

Because here’s the reality. If you shoot too high and have to lower your price after the fact, you could actually end up walking away with lower offers than if you’d priced it right from the start. So, how do you avoid that? You lean on your agent.

A great agent doesn’t just pull a number out of thin air. They’ll use real data and market trends to make sure your house is priced based on what your specific home is valued at today. So, you’re setting a realistic price – one that’ll draw in serious buyers.

And based on your agent’s analysis of your local market, they may even recommend strategically pricing slightly below market value to help your house attract more eyes and more competitive offers. Here’s how your agent will determine the right number for your house:

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

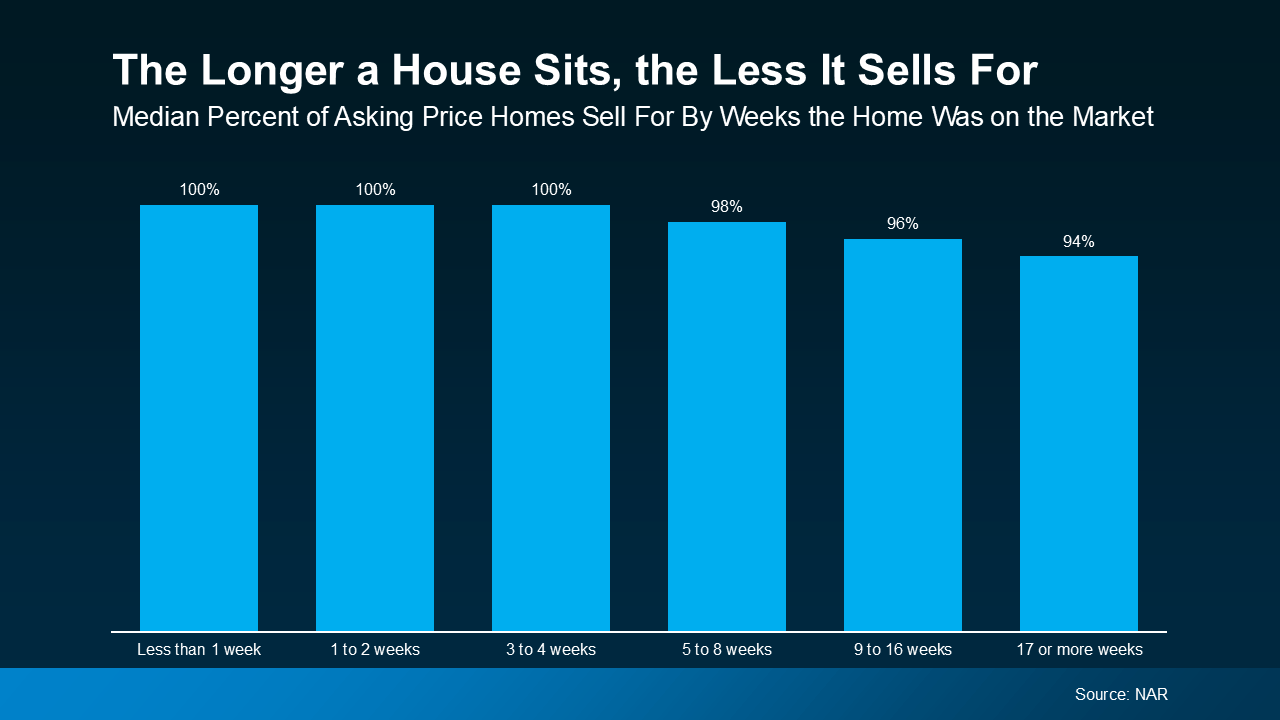

You can see that shake out in the graph below. It uses data from the National Association of Realtors (NAR) to show that the longer a house sits, the less it’ll sell for:

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that's what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

This graph shows that if a house sells within the first 4 weeks it is listed, it usually goes for full price. Based on experience, that's what usually happens to homes that are priced at or just below current market value. If it’s priced right, buyers will be interested, and, ultimately, willing to pay the asking price – or compete with other buyers and even go over asking.

But if a house isn’t priced right, it doesn’t sell as quickly. And this graph shows that, after the first 4 weeks on the market, the price starts to drop from there. That’s because buyer interest falls off the longer it sits. So, it becomes more likely a seller will either accept a lower offer because that’s all they have, or opt to do a price drop to draw people back in.

The last thing you want is to list too high, watch your house sit, and then have to drop the price just to get attention. Want to make sure your home sells quickly and for the best price? Let’s connect and go over the right pricing strategy for your house.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/04/03/the-1-thing-sellers-need-to-know-about-their-asking-price?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Home sellers who are making their moves happen right now all have one thing in common: they’ve adjusted their strategy to match today’s market.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.