Why Buyers Are More Likely To Get Concessions Right Now

Buying Tips Laura Miller Edwards Realty Group May 28, 2025

Buying Tips Laura Miller Edwards Realty Group May 28, 2025

Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive.

When a seller or builder gives you something extra to help with your purchase, that’s called either a concession or an incentive.

Today, some of the most common ones are:

For buyers, getting any of these things thrown in can be a big deal – especially if you’re working with a tight budget. As the National Association of Realtors (NAR) says:

“. . . they can help reduce the upfront costs associated with purchasing a home.”

It’s not just one builder willing to toss in a few extras. A lot of builders are using this tactic lately. As Zonda says:

“Incentives continued to be popular in March, offered by builders on 56% of to-be-built homes and 74% of quick move-in (QMI) homes, which can likely be occupied within 90 days.”

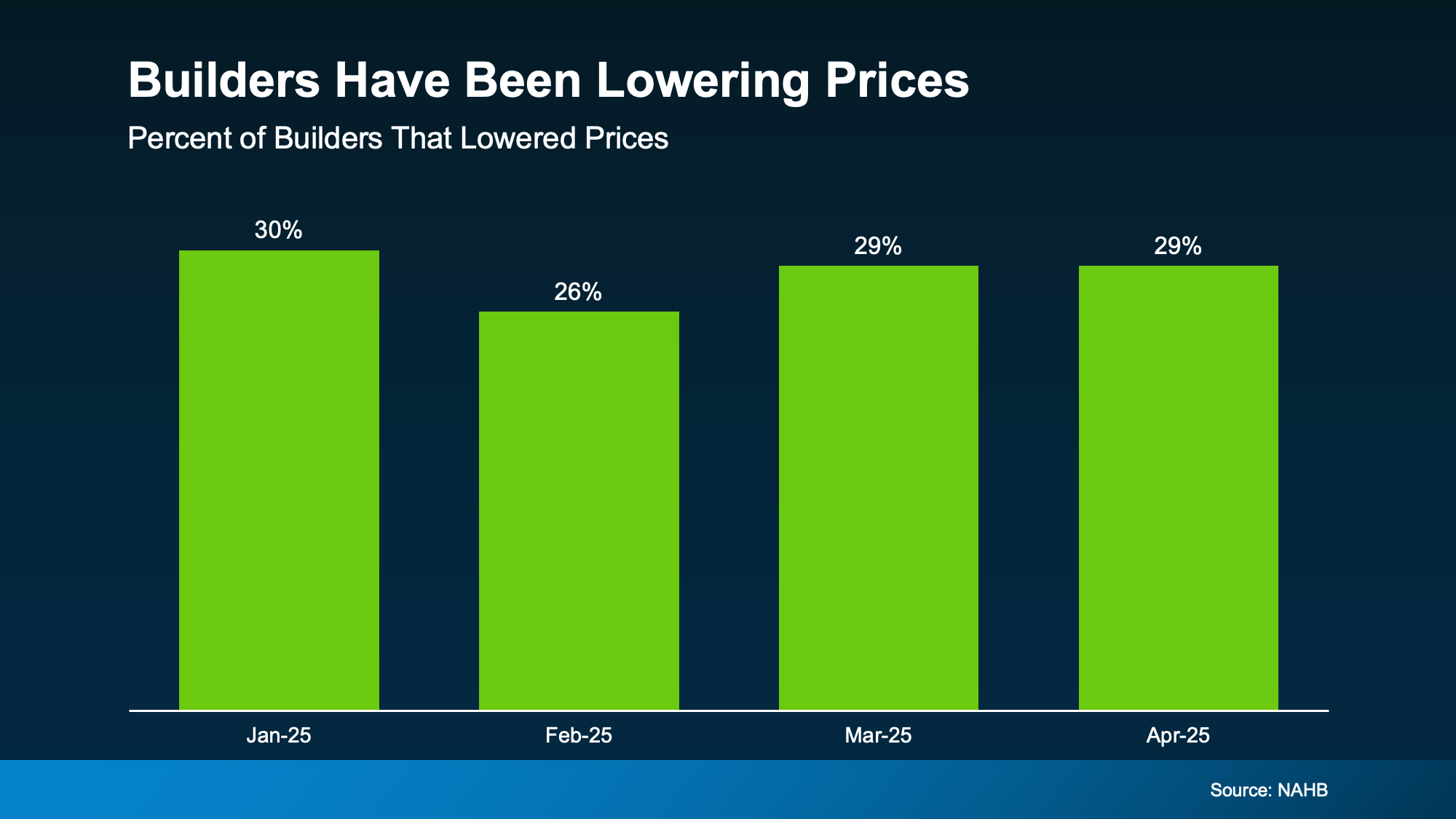

That’s because they don’t want to sit on inventory for too long. They want it to sell. And according to the National Association of Home Builders (NAHB), one of the strategies many builders are using to keep that inventory moving (and not just sitting) is a price adjustment (see graph below):

Around 30% of builders lowered prices in each of the first four months of the year. While that also means most builders aren’t lowering prices, it also shows some are willing to negotiate with buyers to get a deal done.

Around 30% of builders lowered prices in each of the first four months of the year. While that also means most builders aren’t lowering prices, it also shows some are willing to negotiate with buyers to get a deal done.

This isn’t a sign of trouble in the market, it’s an opportunity for you. The fact that the majority of builders offer incentives and roughly 3 in 10 are lowering prices means if you're looking at a newly built home, your builder will probably try to make it easier for you to close the deal.

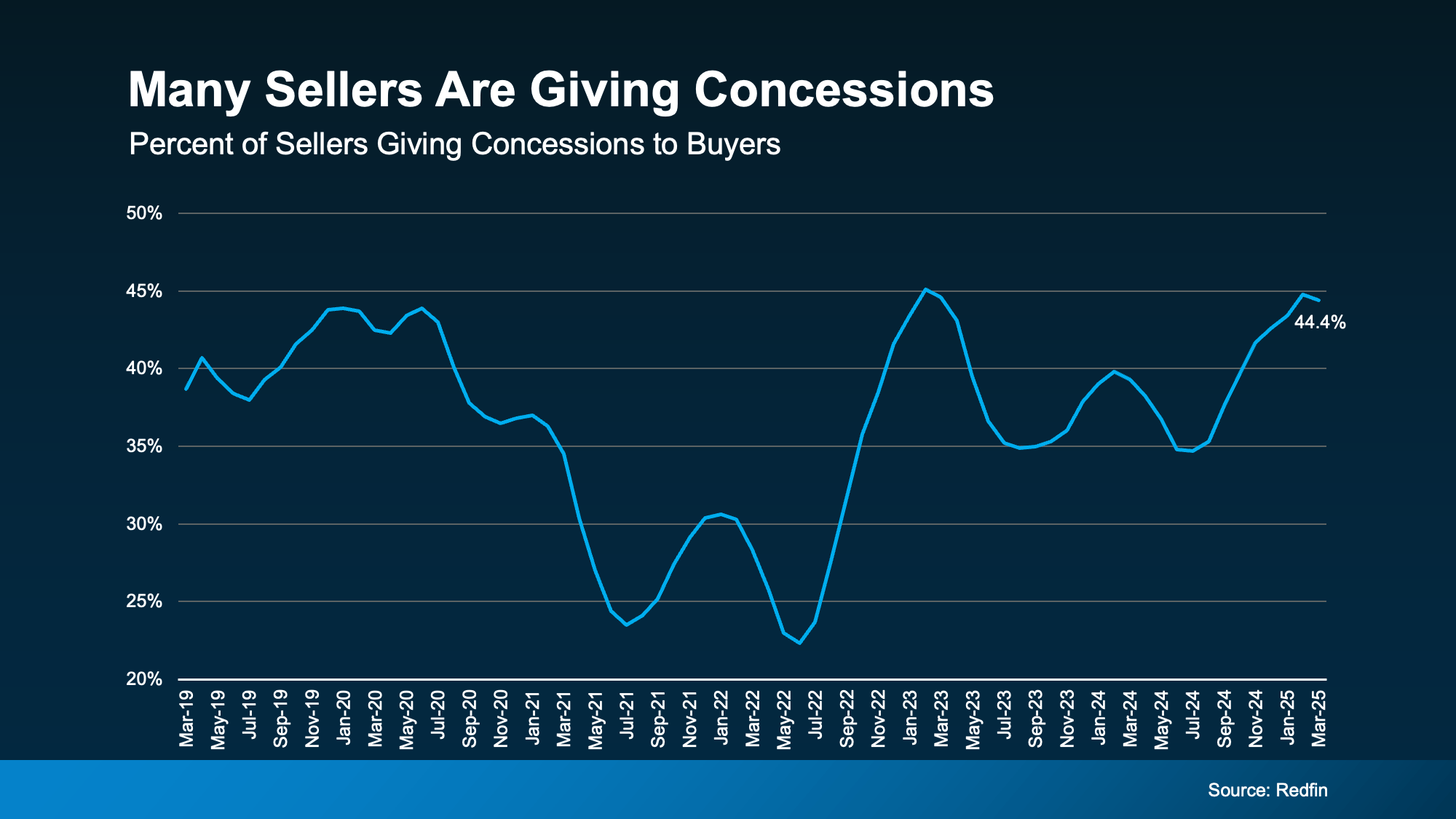

More existing homes (one that someone has lived in before) have been hitting the market, too – which means sellers are facing more competition. That’s why over 44% of sellers of existing homes gave concessions to buyers in March (see graph below):

And, if you look back at pre-pandemic years on this graph, you’ll see 44% is pretty much returning to normal. After years of sellers having all the power, the market is balancing again, which can work in your favor as a buyer.

And, if you look back at pre-pandemic years on this graph, you’ll see 44% is pretty much returning to normal. After years of sellers having all the power, the market is balancing again, which can work in your favor as a buyer.

But remember, concessions don’t always mean a big discount. While more sellers are compromising on price, that’s not always the lever they pull. Sometimes it’s as simple as the seller paying for repairs, leaving appliances behind for you, or helping with your closing costs.

And considering that home values have risen by more than 57% over the course of the past 5 years, small concessions are a great way for sellers to make a house more attractive to buyers while still making a profit.

Whether you’re looking at a newly built home or something a little older, there’s a good chance you can benefit from concessions or incentives.

If a seller or builder offered you something extra, what would make the biggest difference to help you move forward? Let’s talk about it and see if it’s realistic based on inventory and competition in our local market.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/05/13/why-buyers-are-more-likely-to-get-concessions-right-now?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.