Falling Mortgage Rates Are Bringing Buyers Back

Mortgage Rates Laura Miller Edwards Realty Group September 19, 2024

Mortgage Rates Laura Miller Edwards Realty Group September 19, 2024

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.

After months of high rates keeping buyers on the sidelines, things are starting to shift. Rates are already coming down due to a number of economic factors. And yesterday the Federal Reserve cut the Federal Funds Rate for the first time since they began raising that rate in March 2022. And while they don’t control mortgage rates, this sets the stage for mortgage rates to fall even further than they already have – especially since more cuts from the Fed are expected into next year. And lower mortgage rates are bringing more buyers back into the market. Lisa Sturtevant, Chief Economist at Bright MLS, says:

“A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market.”

The best part? You can take advantage of that renewed buyer interest.

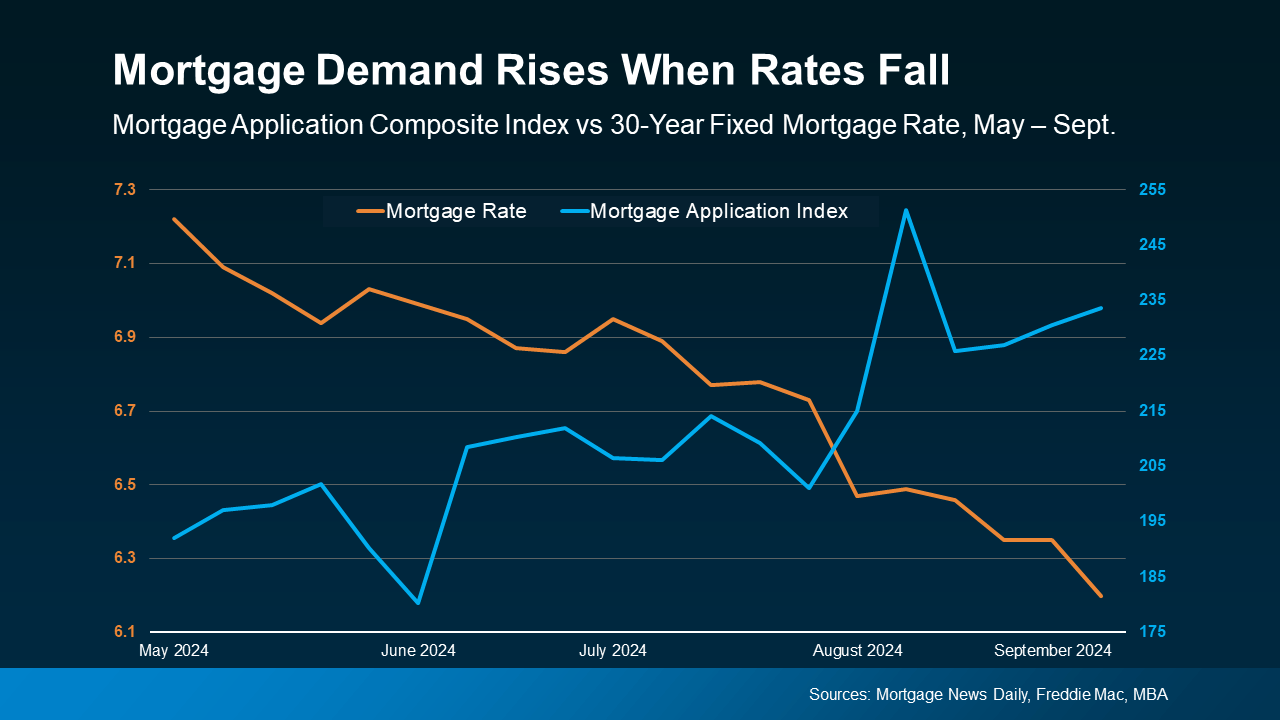

The graph below illustrates the relationship between falling mortgage rates and rising buyer activity. The orange line represents the average 30-year fixed mortgage rate, while the blue line shows the Mortgage Bankers Association (MBA) Mortgage Application Index, which tracks the number of mortgage applications.

As you can see, as mortgage rates (orange) come down, the Mortgage Application Index (blue) rises, showing more people start to re-engage in the process (see graph below):

According to the National Association of Realtors (NAR), home sales increased in July, which was a welcome shift after four straight months of declines. If you're a homeowner thinking about selling, this uptick in buyer activity works in your favor.

More buyers means more competition, which can lead to higher offers and shorter time on the market for your house. And, according to Edward Seiler, AVP of Housing Economics at the Mortgage Bankers Association (MBA), this trend is expected to continue:

“MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market.”

All in all, the market is becoming more accessible to a wider range of buyers, which could result in even more people looking to purchase a house like yours.

With more buyers entering the market, now’s the time to start getting your house ready to sell.

The recent decline in mortgage rates is already driving more buyers into the market, and experts project this trend will continue. Let’s work together to take advantage of this increased buyer demand and get your house ready to sell.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2024/09/19/falling-mortgage-rates-are-bringing-buyers-back?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.