What Credit Score Do You Really Need To Buy a Home?

Buying Tips Laura Miller Edwards Realty Group August 6, 2025

Buying Tips Laura Miller Edwards Realty Group August 6, 2025

According to Fannie Mae, 90% of buyers don’t actually know what credit score lenders are looking for, or they overestimate the minimum needed.

Let that sink in. That means most homebuyers think they need better credit than they actually do – and maybe you’re one of them. And that could make you think buying a home is out of reach for you right now, even if that’s not necessarily true. So, let’s look at what the data really says about credit scores and homebuying.

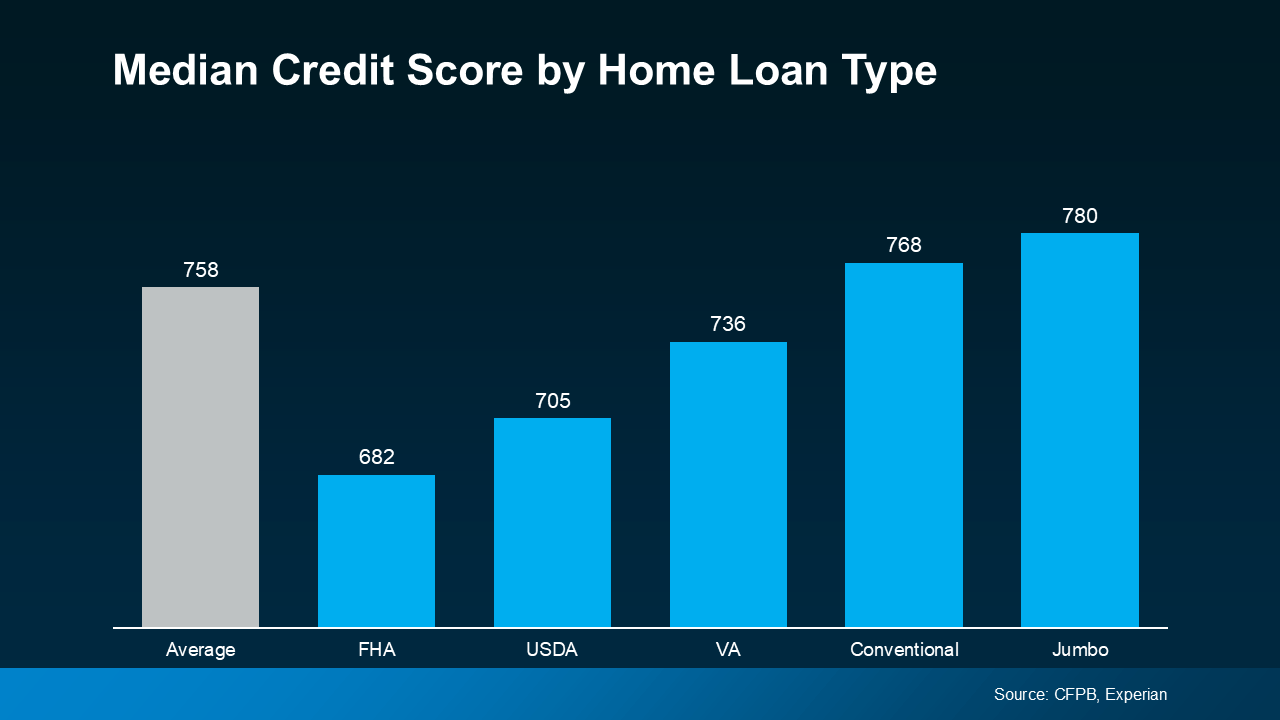

There’s no universal credit score you absolutely have to have when buying a home. And that means there’s more flexibility than most people realize. Check out this graph showing the median credit scores recent buyers had among different home loan types:

Here's what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

Here's what’s important to realize. The numbers vary, and there’s no one-size-fits-all threshold. And that could open doors you thought were closed for you. The best way to learn more is to talk to a trusted lender. As FICO explains:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

When you buy a home, lenders use your credit score to get a sense of how reliable you are with money. They want to see if you typically make payments on time, pay back debts, and more.

Your score can impact which loan types you may qualify for, the terms on those loans, and even your mortgage rate. And since mortgage rates are a big factor in how much house you’ll be able to afford, that may make your score feel even more important today. As Bankrate says:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

That still doesn’t mean your credit has to be perfect. Even if your credit score isn’t as high as you’d like, you may still be able to get a home loan.

And if you talk to a lender and decide you want to improve your score (and hopefully your loan type and terms too), here are a few smart moves according to the Federal Reserve Board:

Your credit score doesn’t have to be perfect to qualify for a home loan. But a better score can help you get better terms on your home loan. The best way to know where you stand and your options for a mortgage is to connect with a trusted lender.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/07/30/what-credit-score-do-you-really-need-to-buy-a-home?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.