How Much Home Equity Have You Gained? The Answer Might Surprise You

Home Equity Laura Miller Edwards Realty Group January 15, 2025

Home Equity Laura Miller Edwards Realty Group January 15, 2025

Have you ever stopped to think about how much wealth you’ve built up just from being a homeowner? As home values rise, so does your net worth. And, if you’ve been in your house for a few years (or longer), there’s a good chance you’re sitting on a pile of equity — maybe even more than you realize.

Home equity is the difference between what your house is worth and what you owe on your mortgage. For example, if your house is worth $500,000 and you still owe $200,000 on your home loan, you have $300,000 in equity. It’s essentially the wealth you’ve built through homeownership. Right now, homeowners across the country are seeing record amounts of equity.

According to Intercontinental Exchange (ICE), the average homeowner with a mortgage has $319,000 in home equity.

The rise in home equity over the years can be credited to two key factors:

1. Significant Home Price Growth

Home prices have climbed dramatically in recent years. In fact, according to the Federal Housing Finance Agency (FHFA), over the past five years, home prices nationwide have risen by 57.4% (see map below):

This appreciation means your house is likely worth much more now than when you first bought it.

This appreciation means your house is likely worth much more now than when you first bought it.

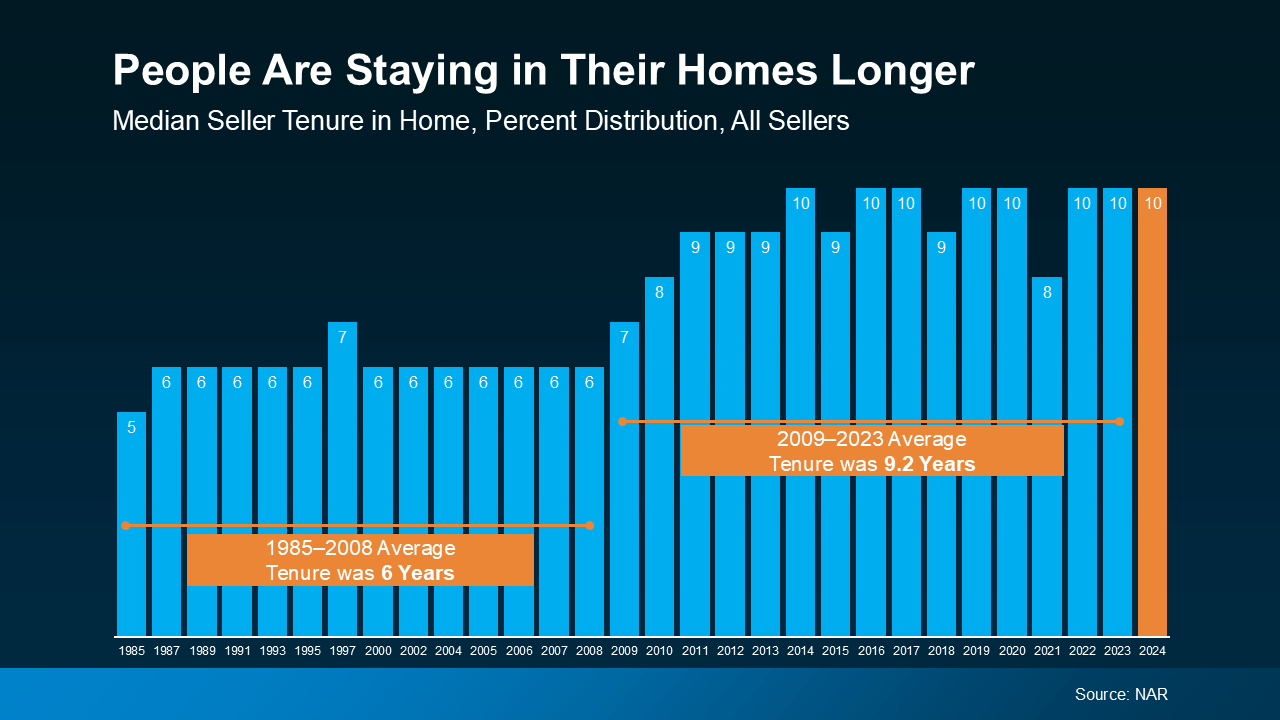

2. Longer Tenure in Homes

Data from the National Association of Realtors (NAR) shows people are staying in their homes for a decade (see graph below):

This increased tenure means homeowners benefit even more from home values growing over time. That’s because the longer someone has lived in their house, the more that home’s value has grown, which directly increases equity.

This increased tenure means homeowners benefit even more from home values growing over time. That’s because the longer someone has lived in their house, the more that home’s value has grown, which directly increases equity.

And if you’re one of those people who’s been in their home for 10 years or more, know this – according to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”

What does that mean for you? It means your house might be your biggest financial asset — and it could open up some exciting opportunities for your future. Let’s break it down.

Your equity could help you cover the down payment for your next home. In some cases, it might even mean you can buy your next house all cash.

Thinking about upgrading your kitchen, adding a home office, or tackling other projects? Your equity can provide the funds to make those improvements happen, increasing your home’s value and making it more enjoyable to live in too.

If you’ve been dreaming about starting your own business, your equity could be the kickstart you need. Whether it’s for startup costs, equipment, or marketing, leveraging your home’s value can help bring your entrepreneurial goals to life.

Whether you’re thinking about selling, upgrading, or simply want to understand your options, your home equity is a powerful resource. If you’re wondering how much equity you’ve built or how you can use it to meet your goals, let’s connect and explore the possibilities.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/01/13/how-much-home-equity-have-you-gained-the-answer-might-surprise-you?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Home Equity

A lot of people are asking the same thing right now: “Is it even a good time to sell?”

For Buyers

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

Community Information

Discover holiday lights, shows, Santa visits, and family events across Cobb County this December.

Selling Tips

The homeowners who win in today’s market aren’t the ones waiting it out or stepping back. They’re the ones who adapt from the start.

Closing Costs

Closing costs can feel confusing. This guide breaks down typical buyer and seller costs in Cobb County.

Mortgage Rates

Affordability is still a challenge. There’s no question about that. But the market has given savvy buyers a head start.

Economy

There’s been a lot of talk lately about how a government shutdown impacts the housing market.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.