The 20% Down Payment Myth, Debunked

First Time Home Buyers Laura Miller Edwards Realty Group May 7, 2025

First Time Home Buyers Laura Miller Edwards Realty Group May 7, 2025

Saving up to buy a home can feel a little intimidating, especially right now. And for many first-time buyers, the idea that you have to put 20% down can feel like a major roadblock.

But that’s actually a common misconception. Here’s the truth.

Unless your specific loan type or lender requires it, odds are you won’t have to put 20% down. There are loan options out there designed to help first-time buyers like you get in the door with a much smaller down payment.

For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants, like Veterans. So, while putting down more money does have its benefits, it’s not essential. As The Mortgage Reports says:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

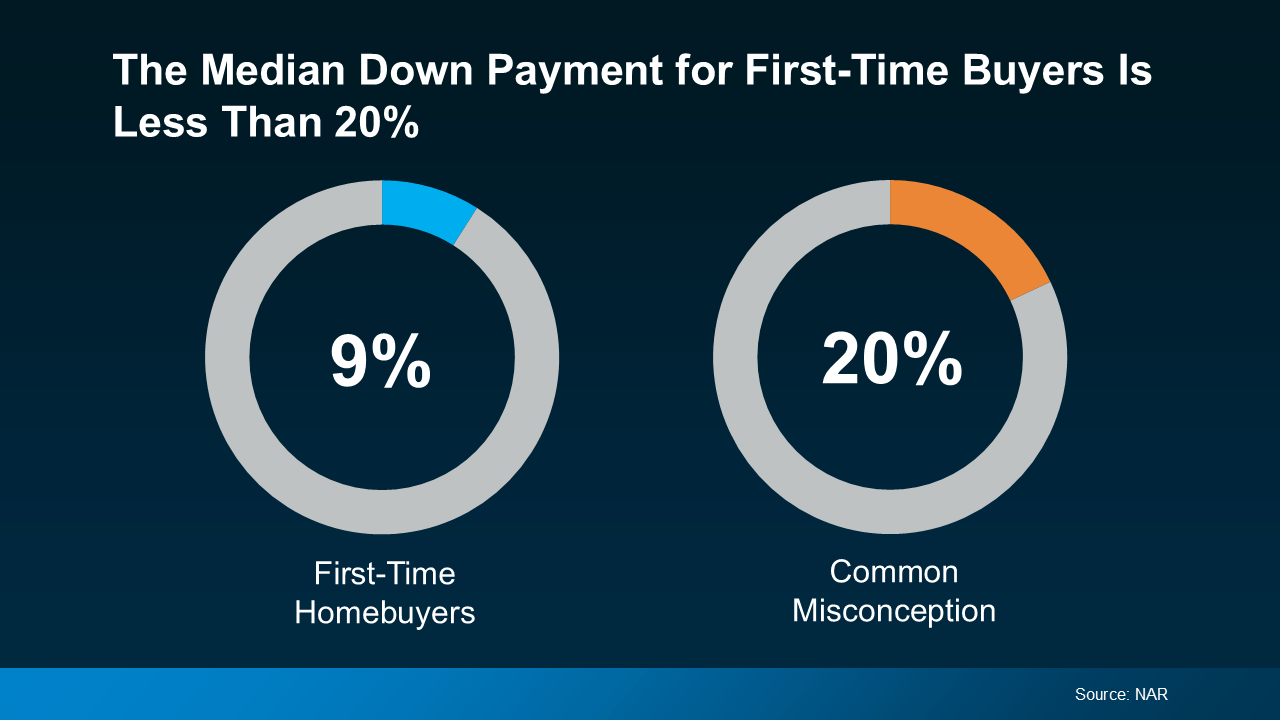

According to the National Association of Realtors (NAR), the median down payment is a lot lower for first-time homebuyers at just 9% (see chart below):

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.

And the best part is, there are also a lot of programs out there designed to give your down payment savings a boost. And chances are, you’re not even aware they’re an option.

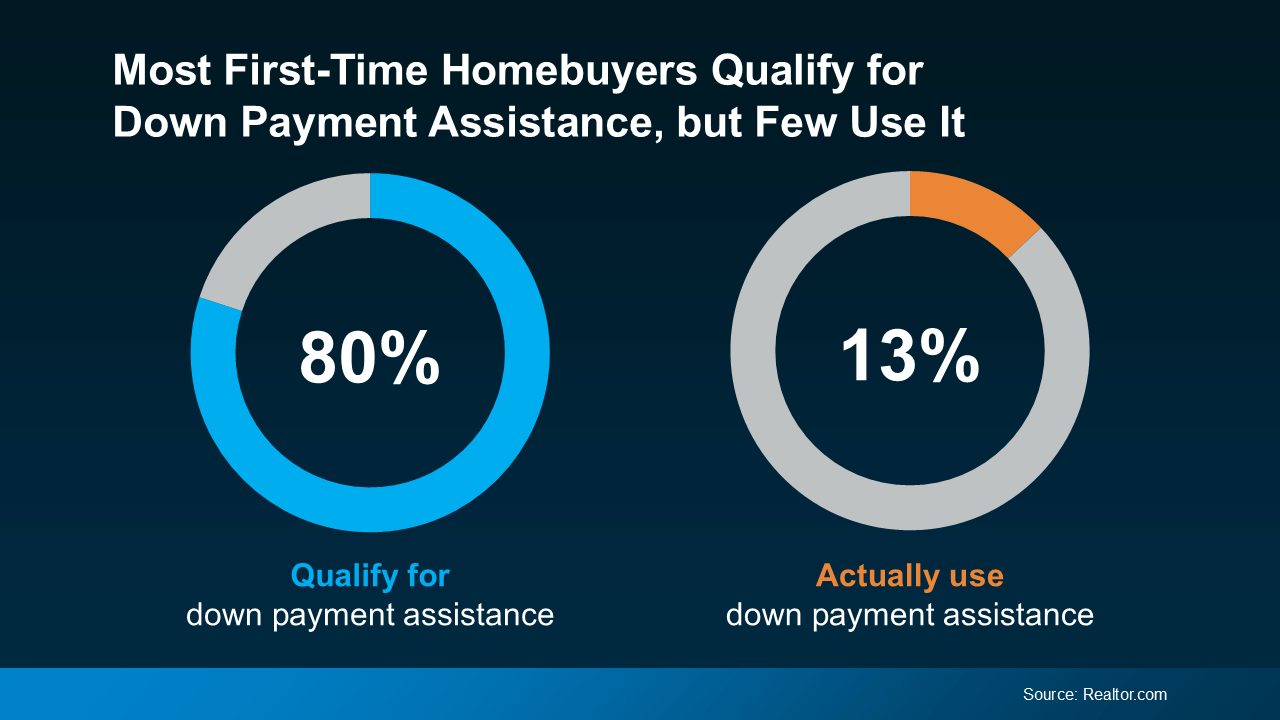

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance (DPA), but only 13% actually use it (see chart below):

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine how much further your homebuying savings would go if you were able to qualify for $17,000 worth of help. In some cases, you may even be able to stack multiple programs at once, giving what you’ve saved an even bigger lift. These are the type of benefits you don't want to leave on the table.

Saving up for your first home can feel like a lot, especially if you’re still thinking you have to put 20% down. The truth is that’s a common myth. Many loan options require much less, and there are even programs out there designed to boost your savings too.

To learn more about what’s available and if you’d qualify for any down payment assistance programs, talk to a trusted lender.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/05/05/the-20-down-payment-myth-debunked?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.