The Majority of Veterans Are Unaware of a Key VA Loan Benefit

Down Payments Laura Miller Edwards Realty Group November 13, 2024

Down Payments Laura Miller Edwards Realty Group November 13, 2024

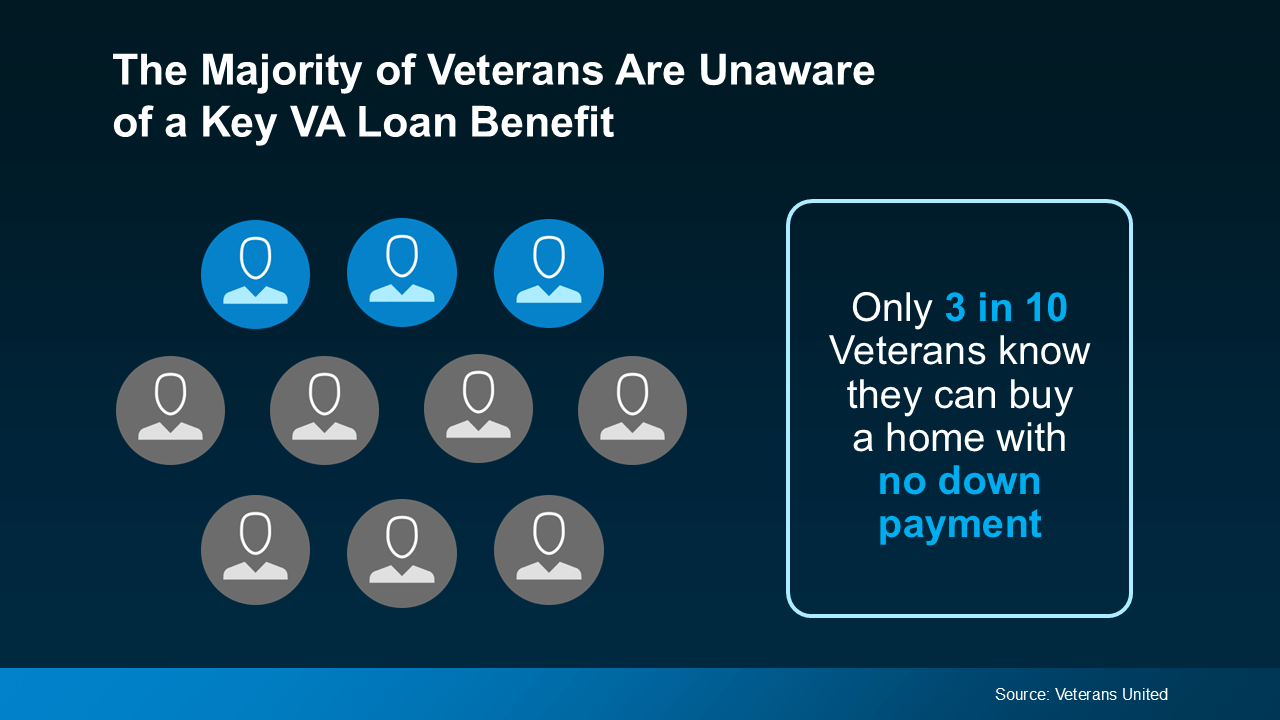

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2024/11/11/the-majority-of-veterans-are-unaware-of-a-key-va-loan-benefit?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Home Equity

A lot of people are asking the same thing right now: “Is it even a good time to sell?”

For Buyers

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.