What You Need To Know About Homeowner’s Insurance

Home Buying Laura Miller Edwards Realty Group April 2, 2025

Home Buying Laura Miller Edwards Realty Group April 2, 2025

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it's a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

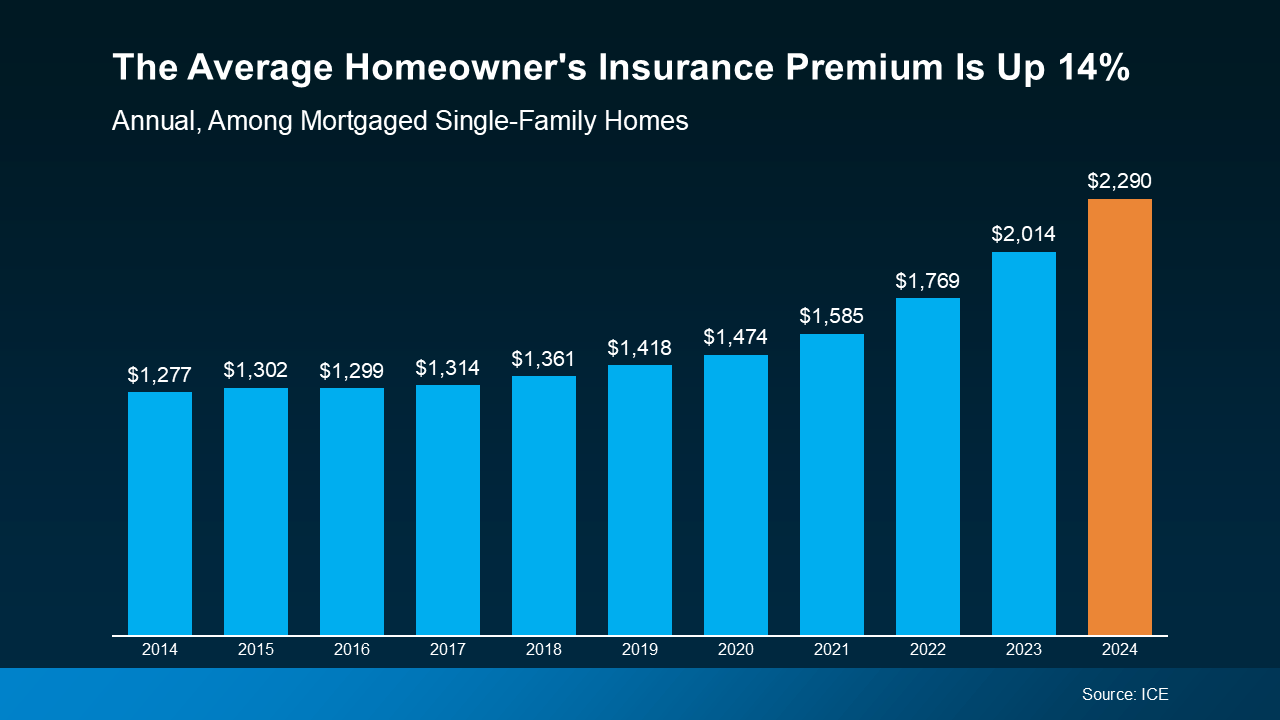

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible. Let’s talk through it and make sure you’re set up for success.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/03/19/what-you-need-to-know-about-homeowners-insurance?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Home sellers who are making their moves happen right now all have one thing in common: they’ve adjusted their strategy to match today’s market.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.