Why Would I Move with a 3% Mortgage Rate?

Mortgage Rates Laura Miller Edwards Realty Group May 21, 2025

Mortgage Rates Laura Miller Edwards Realty Group May 21, 2025

If you have a 3% mortgage rate, you’re probably pretty hesitant to let that go. And even if you’ve toyed with the idea of moving, this nagging thought may be holding you back: “why would I give that up?”

But when you ask that question, you may be putting your needs on the back burner without realizing it. Most people don’t move because of their mortgage rate. They move because they want or need to. So, let’s flip the script and ask this instead:

What are the chances you’ll still be in your current house 5 years from now?

Think about your life for a moment. Picture what the next few years will hold. Are you planning on growing your family? Do you have adult children about to move out? Is retirement on the horizon? Are you already bursting at the seams?

If nothing’s going to change, and you love where you are, staying put might make perfect sense. But if there’s even a slight chance a move is coming, even if it’s not immediate, it’s worth thinking about your timeline.

Because even a year or two can make a big difference in what your next home might cost you.

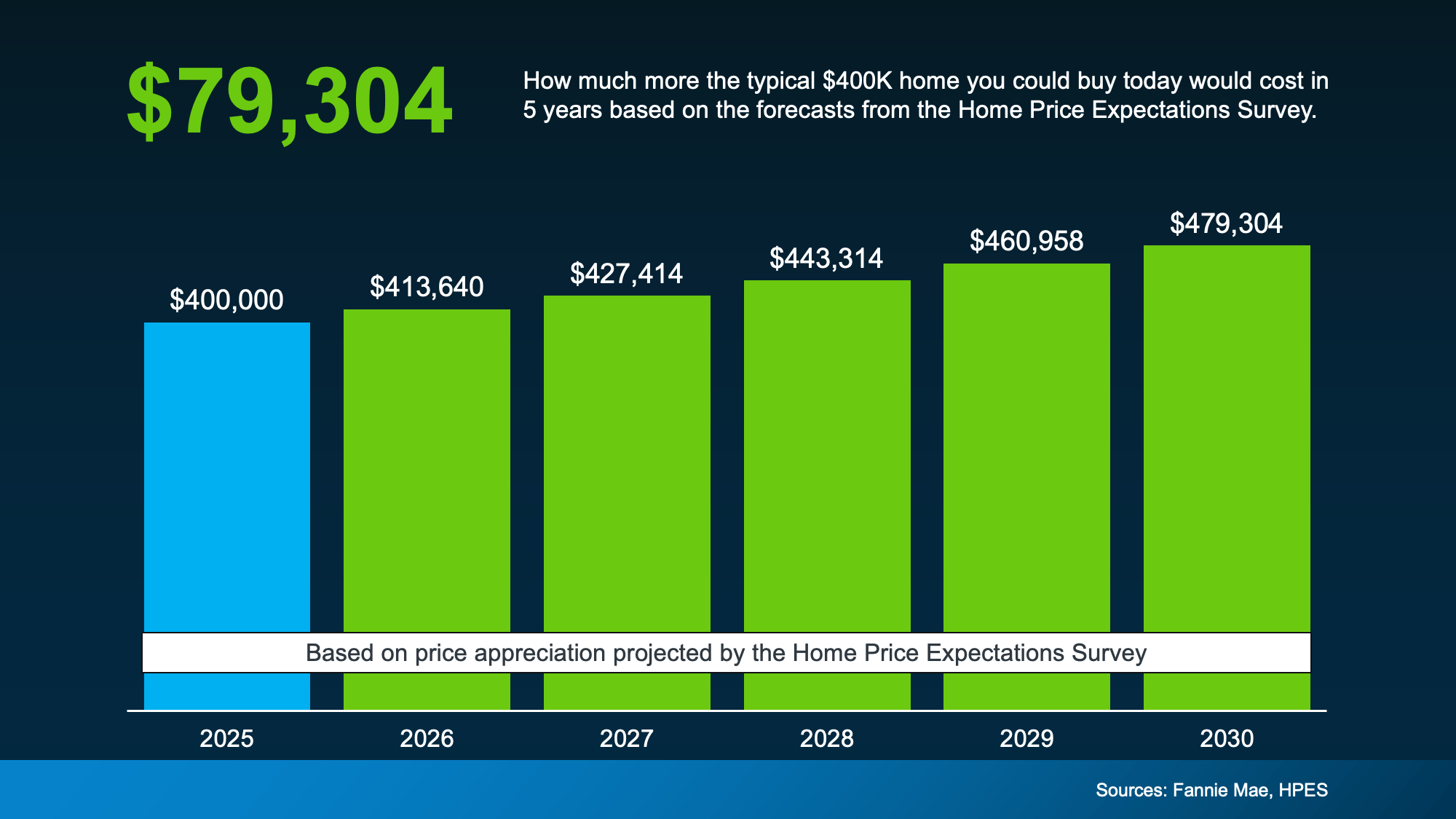

Each quarter, Fannie Mae asks more than 100 housing market experts to weigh in on where they project home prices are headed. And the consensus is clear. Home prices are expected to rise through at least 2029 (see graph below):

While those projections aren’t calling for big increases each year, it's still an increase. And sure, some markets may see flatter prices or slower growth, or even slight dips in the short term. But look further out. In the long run, prices almost always rise. And over the next 5 years, the anticipated increase – however slight – will add up fast.

While those projections aren’t calling for big increases each year, it's still an increase. And sure, some markets may see flatter prices or slower growth, or even slight dips in the short term. But look further out. In the long run, prices almost always rise. And over the next 5 years, the anticipated increase – however slight – will add up fast.

Here’s an example. Let's say you'll be looking to buy a roughly $400,000 house when you move. If you wait and move 5 years from now, based on these expert projections, it could cost nearly $80,000 more than it would now (see graph below):

That means the longer you wait, the more your future home will cost you.

That means the longer you wait, the more your future home will cost you.

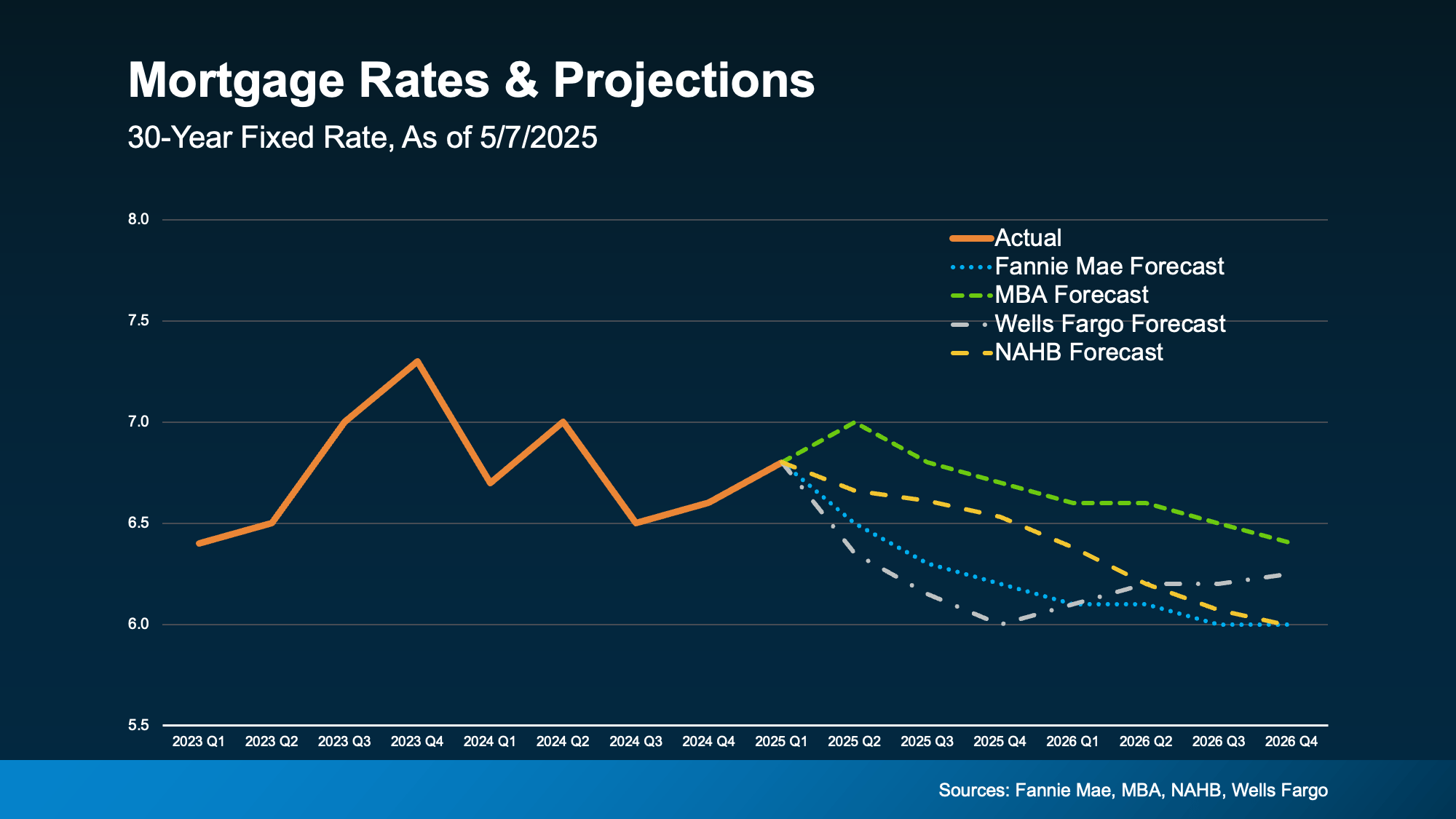

If you know a move is likely in your future, it may make sense to really think about your timeline. You certainly don't have to move now. But financially, it may still be worth having a conversation about your options before prices inch higher. Because while rates are expected to come down, it’s not by much. And if you’re holding out in hopes we’ll see the return of 3% rates, experts agree it’s just not in the cards (see graph below):

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

So, the question really isn’t: “why would I move?” It’s: “when should I?” – because when you see the real numbers, waiting may not be the savings strategy you thought it was. And that’s the best conversation you can have with your trusted agent right now.

Keeping that low mortgage rate is smart – until it starts holding you back.

If a move is likely on the horizon for you, even if it’s a few years down the line, it’s worth thinking through the numbers now, so you can plan ahead. What other price point do you want to see these numbers for? Let’s have that conversation, so we can show you how the math adds up. That way, you can make an informed decision about your timeline.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2025/05/15/why-would-i-move-with-a-3-mortgage-rate?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.