The Down Payment Assistance You Didn’t Know About

For Buyers Laura Miller Edwards Realty Group September 25, 2024

For Buyers Laura Miller Edwards Realty Group September 25, 2024

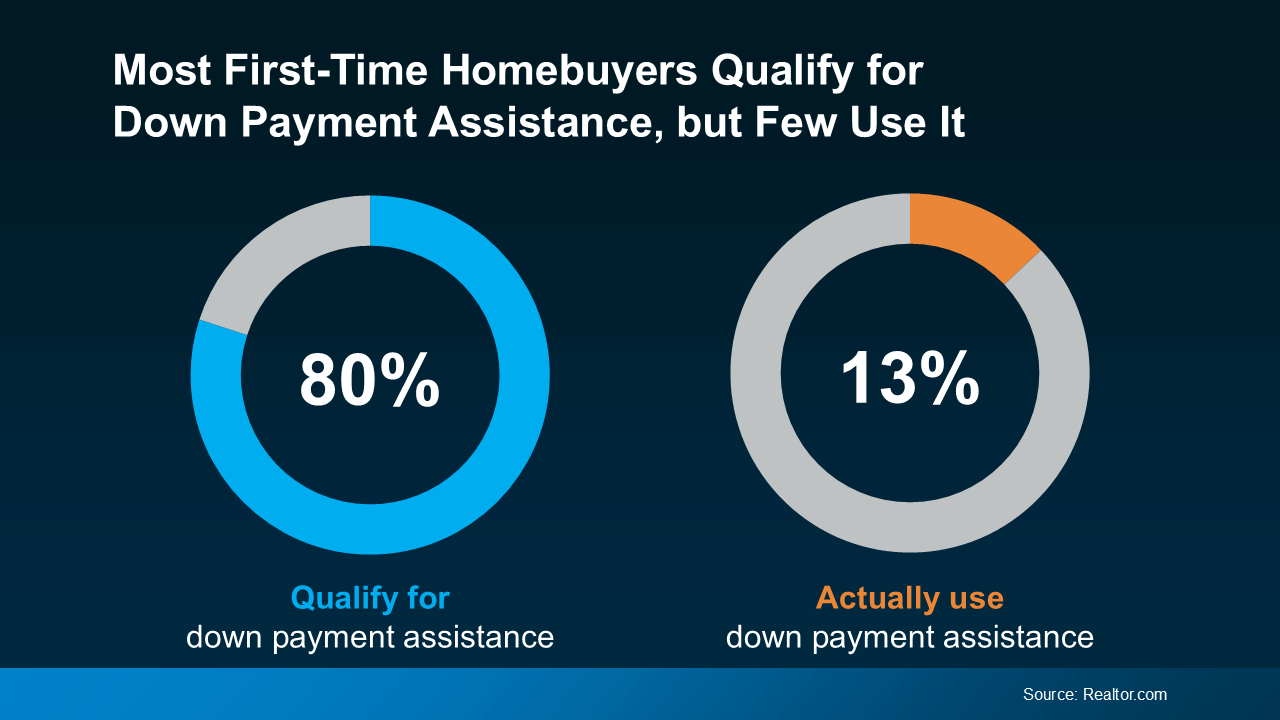

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it. And if you’re hoping to buy a home, this is a mission-critical gap to close – fast (see graph below):

Here’s what you need to know to make the most of your down payment in today’s housing market.

For first-time buyers, the name of the game with down payments is making sure you’re taking advantage of all the resources out there designed to help you. And a bunch of them can get you to your goal faster than you may have thought possible.

For example, there are loan options that require as little as 3% down, or even 0% for certain qualified borrowers, like Veterans. And let’s not forget down payment assistance, like grants and other opportunities, that help you cover the upfront cost of your down payment.

If you’re interested in exploring those options and what you may be able to use to your advantage, connect with a trusted lender. Because if you don't at least see what’s available, you could be leaving money on the table and missing your chance at buying a home. These resources can boost your down payment. And a higher down payment could help lower your eventual monthly mortgage payment, and even avoid or reduce your fees like private mortgage insurance.

There’s one more thing to address. News coverage has been talking about how the typical down payment is rising. A report from Redfin states:

“The typical down payment for U.S. homebuyers hit a record high of $67,500 in June, up 14.8% from $58,788 a year earlier . . . This was the 12th consecutive month the median down payment rose year over year.”

But don’t let those high dollars scare you. Just because the average down payment is rising doesn’t mean down payment requirements are going up. That’s a key piece of the puzzle to understand. It’s really just because people are choosing to put more down to try to offset higher mortgage rates, and current homeowners who are putting their equity to work are using that to increase their down payment on their next home. As HousingWire explains:

“. . . buyers are putting down a higher percentage of the purchase price to lower their monthly mortgage payment. And buyers also had more equity from their home sales, which gives them more cushion.”

Let’s break those two reasons down a bit:

1. A bigger down payment helps lower your monthly mortgage payment. Affordability has been a challenge for many buyers recently, which is why those who have the ability to make a bigger down payment are going to do so in an effort to lower their future housing costs.

2. Buyers who already own a home have a record amount of equity to leverage. Someone who bought a home a few years ago has gained a significant amount of value in their house, thanks to home price appreciation. These people can put down much more than the average first-time buyer who hasn’t owned a home yet.

What’s the best thing to do? Talk with a trusted lender about your options. They’ll help you figure out where you stand today and how to access the resources you may qualify for. Because help is out there, you just need to work with a pro to take advantage of it.

This blog post previously appeared on https://www.simplifyingthemarket.com/en/2024/09/24/the-down-payment-assistance-you-didnt-know-about?a=106260-312309902871c1f0d820820f58bf8fde. The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. and the Laura Miller Edwards Realty Group will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Stay up to date on the latest real estate trends.

Pricing

There’s one decision you're going to make when you sell that determines whether your house sells quickly.

For Buyers

If you’re planning to buy a home this year, buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Home Buying

Deciding between a new build or a well-kept resale in Cartersville? This guide will help.

Downsize

If you’re considering retiring soon, here’s what you should be thinking about.

Buying Tips

A few years ago, homes sold in just a matter of days. But that’s no longer the baseline.

Agent Value

This guide breaks down homestead exemption in Cobb County.

Selling Tips

Selling as-is can make sense in certain situations. Here’s what you need to know.

Home Buying

While housing market conditions are definitely a factor in your decision to become a homeowner, your own personal situation and finances matter too.

Forecasts

If a move is on your radar for 2026, there’s a lot more working in your favor than there has been in a while.

Get assistance in determining current property value, crafting a competitive offer, writing and negotiating a contract, and much more. Contact us today.